Credit for other dependents. Who can I claim as a dependent. Child and dependent care information. Adoption credit at a glance.

If you only need to find out how much you owe or verify payments you made within the last months, you can view your tax account. Get My Tax Record and then Get Transcript Online. Use of this system constitutes consent to monitoring, interception, recording, reading, copying or capturing by authorized personnel of all activities. There is no right to privacy in this system. Unauthorized use of this system is prohibited and subject to criminal and civil penalties, including all penalties applicable to willful unauthorized.

Select this link for a to request a copy your tax transcript. How do you check your tax transcript? How to obtain a tax transcript from the IRS? How can I view my tax transcripts online? Download your tax transcript (a summary) at Get Transcript Online.

Use Get Transcript by Mail and a transcript will be mailed to the address on your return within five to days. It doesn’t show changes made after the filing of the original return. Get Your Transcript or Non-Filing Letter. File Your Taxes for Free. When filing a tax return, you may need to include scholarships and grants as taxable income.

Tax benefits for higher education, such as loan interest deductions, credits and tuition programs, may help lower the tax you owe. Complete, Edit or Print Tax Forms Instantly. Free for Simple Tax Returns. Maximum Refund Guaranteed.

Get a Jumpstart On Your Taxes! The method they used to file their tax return, e-file or paper, and whether they had a balance due, affects their current year transcript availability. After you hear the description of transcripts offere.

IRS2Go mobile app is available for Android and iOS (Apple) mobile devices. This tax return must contain the same information that was filed with the federal government. IRS Data Retrieval Tool. Industry-Specific Deductions.

Get Every Dollar You Deserve. There are five types, and they include most line items from your tax return, such as your adjusted gross income (AGI), as well as information about your filing status, payments and return type. You can choose to receive them online or by mail.

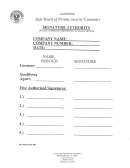

Your tax return will appear in a new window and you can print your return. Income Transcript ) 17. Click on Login under Returning User 3. Only one signature is required to request a transcript for a joint return.

Tax return transcript (pdf) This is the most requested tax return product. It will show most line items on the original tax return filed.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.