This includes taxpayers who owe alternative minimum tax or certain other taxes , and people with long-term capital gains or qualified dividends. For example, if you calculate that you have tax liability of $ 0(based on your taxable income and your tax bracket) and you are eligible for a tax credit of $ 2that would reduce your liability to $ 800. You would only owe $ 800. Tax credits are only awarded in certain circumstances, however.

Think of this as your. Income Tax Calculator The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

It is mainly intended for residents of the U. State Forms are not listed here. Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. How to compute your total taxable income? What is the formula for income tax?

How do I …calculate my taxable income? Quickly forecast your tax refund amount with TaxCaster, the convenient tax return calculator that’s always up-to-date on the latest tax laws. Estimate your tax refund.

This interactive, income tax estimator provides accurate insight into how much you may get back this year or what you may owe before you file. The most common pre-tax contributions are for retirement accounts such as a 4(k) or 4(b). So if you elect to save of your income in your company’s 4(k) plan, of your pay will come out of each paycheck.

If you increase your contributions, your paychecks will get smaller. If the amount of income tax withheld from your salary or pension is not enough, or if you receive income such as interest, dividends, alimony, self-employment income , capital gains, prizes and awards, you may have to make estimated tax payments. This tax calculator is solely an estimation tool and should only be used to estimate your tax liability or refund.

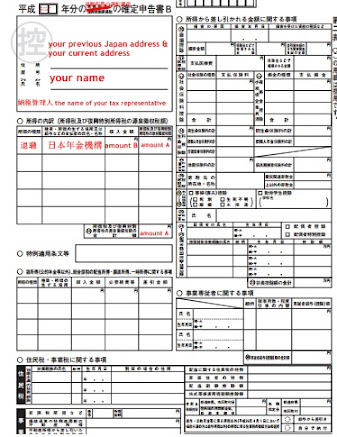

It should not be used for any other purpose, such as preparing a federal income tax return, or to estimate anything other than your own personal tax liability. Follow these steps to calculate your federal income tax bracket: Select your federal tax filing status (most married couples benefit by filing jointly). Enter your total, gross income (TaxAct will automatically estimate the taxable portion Add any 4(k) and IRA pre- tax contributions. The tax calculator looks like a regular IRS income tax form and lets you enter your actual or estimated income , dependent, deduction, and tax credit information. There is no need to enter sensitive personal information such as your name or Social Security Number.

Your maximum tax bracket is. Tax calculated using Qualified dividend and Capital gain tax worksheet is $. It may vary from the taxes calculated directly using the tax brackets above. Taxes are unavoidable and without planning, the annual tax liability can be very uncertain.

Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates. In its simplest form, tax returns are issued when the amount of money being withheld from your paycheck for taxes exceeds the amount you owe the IRS.

When this happens, you are due a tax return from the government. Conversely, you may owe if the money you withheld is too low. Above that level, only the 2. Medicare tax applies.

Taxes are calculated on your income each year as you receive it, much like how it works before you retire.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.